Transactions

800 Super

800 Super

Industry

Industrials

Singapore,

Transaction size

>SGD600m

Date

Sep 2025

Adviser to Mr. William Lee on the sale of his shares in 800 Super and the rollover of a portion of his interest into an Actis-controlled SPV.

800 Super is a leading integrated environmental solutions provider in Singapore, operating across four core segments: waste management, waste treatment, integrated public cleaning, and other environmental services. It is also one of only three licensed public waste collectors in Singapore, providing essential municipal waste collection services.

800 Super

Industry

Industrials

Transaction size

>SGD600m

Date

Sep 2025

Adviser to Mr. William Lee on the sale of his shares in 800 Super and the rollover of a portion of his interest into an Actis-controlled SPV.

800 Super is a leading integrated environmental solutions provider in Singapore, operating across four core segments: waste management, waste treatment, integrated public cleaning, and other environmental services. It is also one of only three licensed public waste collectors in Singapore, providing essential municipal waste collection services.

800 SuperIndustrials

Adviser to Mr. William Lee on the sale of his shares in 800 Super and the rollover of a portion of his interest into an Actis-controlled SPV....

Hyva Group

Hyva Group

Industry

Industrials

Transaction size

US$425 million

Date

14 October 2024

Adviser to Unitas Capital and CTF Services (formerly known as NWS Holdings) on the sale of Hyva Group to JOST World

Headquartered in the Netherlands, Hyva is a leading global supplier of hydraulic solutions for commercial vehicles and the world’s leading producer of front-end tipping cylinders. With more than 3,000 employees around the world, Hyva’s manufacturing footprint encompasses 12 production facilities in China, India, Brazil, Mexico, Germany and Italy, serving customers in more than 110 countries across a range of industries, including transport, agriculture, construction, mining and environmental services.

Hyva Group

Industry

Industrials

Transaction size

US$425 million

Date

14 October 2024

Adviser to Unitas Capital and CTF Services (formerly known as NWS Holdings) on the sale of Hyva Group to JOST World

Headquartered in the Netherlands, Hyva is a leading global supplier of hydraulic solutions for commercial vehicles and the world’s leading producer of front-end tipping cylinders. With more than 3,000 employees around the world, Hyva’s manufacturing footprint encompasses 12 production facilities in China, India, Brazil, Mexico, Germany and Italy, serving customers in more than 110 countries across a range of industries, including transport, agriculture, construction, mining and environmental services.

Philippine Coastal Storage

Philippine Coastal Storage

Industry

Infrastructure

Transaction size

US$510 million

Date

23 October 2024

Adviser to I Squared Capital on the acquisition of Philippine Coastal Storage & Pipeline Corporation from Keppel Infrastructure Trust (KIT) and Metro Pacific Investments Corporation (MPIC)

PCSPC is the largest petroleum products import storage facility in the Philippines, with a storage capacity of approximately 6 million barrels across three tank farms and a marine terminal area comprising a combined land size of approximately 150 hectares.

Philippine Coastal Storage

Industry

Infrastructure

Transaction size

US$510 million

Date

23 October 2024

Adviser to I Squared Capital on the acquisition of Philippine Coastal Storage & Pipeline Corporation from Keppel Infrastructure Trust (KIT) and Metro Pacific Investments Corporation (MPIC)

PCSPC is the largest petroleum products import storage facility in the Philippines, with a storage capacity of approximately 6 million barrels across three tank farms and a marine terminal area comprising a combined land size of approximately 150 hectares.

Philippine Coastal StorageInfrastructure

Adviser to I Squared Capital on the acquisition of Philippine Coastal Storage & Pipeline Corporation from Keppel Infrastructure Trust (KIT)......

Island Hospital

Island Hospital

Industry

Healthcare

All, Malaysia,

Transaction size

US$966m

Date

4 September 2024

Adviser to Affinity Equity Partners on the sale of Island Hospital to IHH Healthcare Berhad

Island Hospital is the leading 600-bed quaternary healthcare provider in Penang, Malaysia, with 120 specialists across 9 Centres of Excellence (“COE”). Currently, it is the leading hospital for medical tourism, attracting 1 in 3 inbound foreign patients to Malaysia. With accreditation from the Australian Council on Healthcare Standards (“ACHS”), it is one of a select few hospitals in Southeast Asia with an ACHS cancer care COE and cardiology COE

Island Hospital

Industry

Healthcare

Transaction size

US$966m

Date

4 September 2024

Adviser to Affinity Equity Partners on the sale of Island Hospital to IHH Healthcare Berhad

Island Hospital is the leading 600-bed quaternary healthcare provider in Penang, Malaysia, with 120 specialists across 9 Centres of Excellence (“COE”). Currently, it is the leading hospital for medical tourism, attracting 1 in 3 inbound foreign patients to Malaysia. With accreditation from the Australian Council on Healthcare Standards (“ACHS”), it is one of a select few hospitals in Southeast Asia with an ACHS cancer care COE and cardiology COE

Island HospitalHealthcare

Island Hospital is the leading 600-bed quaternary healthcare provider in Penang, Malaysia, with 120 specialists...

Asia Pacific University

Asia Pacific University

Industry

Education

Malaysia,

Transaction size

Undisclosed

Date

Oct 2023

Advisor to TPG’s The Rise Fund on the acquisition of Asia Pacific University from KV Asia

Asia Pacific University is the leading technology-focused private university in Malaysia. In October 2023, The Rise Fund (TPG’s multi-sector global impact investing platform) acquired Asia Pacific University along with co-investors including Malaysian funds, KWAP and EPF. This transaction marks TPG’s second tertiary education investment in Malaysia following the acquisition of International Medical University (IMU) in March 2023.

Asia Pacific University

Industry

Education

Transaction size

Undisclosed

Date

Oct 2023

Advisor to TPG’s The Rise Fund on the acquisition of Asia Pacific University from KV Asia

Asia Pacific University is the leading technology-focused private university in Malaysia. In October 2023, The Rise Fund (TPG’s multi-sector global impact investing platform) acquired Asia Pacific University along with co-investors including Malaysian funds, KWAP and EPF. This transaction marks TPG’s second tertiary education investment in Malaysia following the acquisition of International Medical University (IMU) in March 2023.

Asia Pacific UniversityEducation

Asia Pacific University is the leading technology-focused private university in Malaysia. In October 2023

International Medical University

International Medical University

Industry

Healthcare

Malaysia,

Transaction size

US$306M

Date

March 2023

Adviser to IHH Healthcare on the sale of International Medical University (IMU) to TPG’s The Rise Fund and the Hong Leong Group

IMU is the largest healthcare-focused university in Malaysia with a leading market share in medicine and dentistry programmes. In March 2023, IMU was divested by IHH Healthcare to a consortium led by TPG’s The Rise Fund and Hong Leong Group for a total enterprise value of MYR 1,345 million (US$306M), representing one of the largest higher education transactions in Southeast Asia to date.

International Medical University

Industry

Healthcare

Transaction size

US$306M

Date

March 2023

Adviser to IHH Healthcare on the sale of International Medical University (IMU) to TPG’s The Rise Fund and the Hong Leong Group

IMU is the largest healthcare-focused university in Malaysia with a leading market share in medicine and dentistry programmes. In March 2023, IMU was divested by IHH Healthcare to a consortium led by TPG’s The Rise Fund and Hong Leong Group for a total enterprise value of MYR 1,345 million (US$306M), representing one of the largest higher education transactions in Southeast Asia to date.

International Medical UniversityHealthcare

Adviser to IHH Healthcare on the sale of International Medical University (IMU) to TPG’s The Rise Fund and the Hong Leong Group

Sahyadri Hospitals

Sahyadri Hospitals

Industry

Healthcare

All, India,

Transaction size

Undisclosed

Date

August 16, 2022

Adviser to Everstone Group on the sale of its significant majority stake in Sahyadri Hospitals to Ontario Teachers’ Pension Plan.

Sahyadri Hospitals is the largest private hospital chain in the state of Maharashtra, consisting of 8 hospitals with c.900 operating beds and 300 critical-care beds. In addition, the hospital chain has plans to grow capacity by over 500 beds during the next five years. With 2,000 clinicians along with 2,600 supporting staff across its network of hospitals, Sahyadri’s facilities are concentrated around the city of Pune, which is the second largest city in Maharashtra by population.

Sahyadri Hospitals

Industry

Healthcare

Transaction size

Undisclosed

Date

August 16, 2022

Adviser to Everstone Group on the sale of its significant majority stake in Sahyadri Hospitals to Ontario Teachers’ Pension Plan.

Sahyadri Hospitals is the largest private hospital chain in the state of Maharashtra, consisting of 8 hospitals with c.900 operating beds and 300 critical-care beds. In addition, the hospital chain has plans to grow capacity by over 500 beds during the next five years. With 2,000 clinicians along with 2,600 supporting staff across its network of hospitals, Sahyadri’s facilities are concentrated around the city of Pune, which is the second largest city in Maharashtra by population.

Sahyadri HospitalsHealthcare

Adviser to Everstone Group on the sale of its significant majority stake in Sahyadri Hospitals to Ontario Teachers’ Pension Plan.

Goodpack

Goodpack

Industry

Transport & Logistics

All, Singapore,

Transaction size

Confidential

Date

December 2022

Adviser to Goodpack (investee company of KKR) with respect to a structured investment by Goldman Sachs Infrastructure Partners, as part of a broader transaction to refinance the business and provide capital for the next stage of Goodpack’s growth.

Headquartered in Singapore, Goodpack is a leading supply chain solution provider. Its customers are leaders within the synthetic rubber, finished tire, food processing and automotive component industries. Goodpack owns and operates the largest global fleet of metal returnable containers (c.4m), which are designed to replace incumbent one-way, limited-use or non-cubic form packaging.

Goodpack

Industry

Transport & Logistics

Transaction size

Confidential

Date

December 2022

Adviser to Goodpack (investee company of KKR) with respect to a structured investment by Goldman Sachs Infrastructure Partners, as part of a broader transaction to refinance the business and provide capital for the next stage of Goodpack’s growth.

Headquartered in Singapore, Goodpack is a leading supply chain solution provider. Its customers are leaders within the synthetic rubber, finished tire, food processing and automotive component industries. Goodpack owns and operates the largest global fleet of metal returnable containers (c.4m), which are designed to replace incumbent one-way, limited-use or non-cubic form packaging.

GoodpackTransport & Logistics

Adviser to Goodpack (investee company of KKR) with respect to a structured investment by Goldman Sachs Infrastructure Partners, as part of a...

800 Super

800 Super

Industry

Industrials

All, Singapore,

Transaction size

~S$500m

Date

Oct 2022

Advisor to the Lee Family and KKR on the sale of 800 Super to a consortium led by Keppel

800 Super is one of the largest independent waste-focused environmental services platforms in Singapore. The group owns the second largest controlled waste treatment facility that is uniquely integrated within a self-sustaining ecosystem (a first locally), and the group is also a market leader in the provision of municipal waste management and integrated public cleaning services.

800 Super

Industry

Industrials

Transaction size

~S$500m

Date

Oct 2022

Advisor to the Lee Family and KKR on the sale of 800 Super to a consortium led by Keppel

800 Super is one of the largest independent waste-focused environmental services platforms in Singapore. The group owns the second largest controlled waste treatment facility that is uniquely integrated within a self-sustaining ecosystem (a first locally), and the group is also a market leader in the provision of municipal waste management and integrated public cleaning services.

800 SuperIndustrials

Advisor to the Lee Family and KKR on the sale of 800 Super to a consortium led by Keppel

Purplle

Purplle

Industry

Technology

All, India,

Transaction size

US$45M

Date

March 2021

Adviser to Verlinvest, Sequoia, JSW Ventures and Blume on their acquisition of a USD45m secondary stake in Purplle

Purplle is one of India’s largest online beauty products retailer. Founded in 2012, Purplle has over 70 million monthly active users and retails over 50,000 SKUs from over 1,000 brands on its website and mobile app. Its portfolio of owned brands includes Good Vibes, NY bae, StayQuirky and Alps Goodness.

Purplle

Industry

Technology

Transaction size

US$45M

Date

March 2021

Adviser to Verlinvest, Sequoia, JSW Ventures and Blume on their acquisition of a USD45m secondary stake in Purplle

Purplle is one of India’s largest online beauty products retailer. Founded in 2012, Purplle has over 70 million monthly active users and retails over 50,000 SKUs from over 1,000 brands on its website and mobile app. Its portfolio of owned brands includes Good Vibes, NY bae, StayQuirky and Alps Goodness.

PurplleTechnology

Purplle is one of India’s largest online beauty products retailer. Founded in 2012, Purplle has over 70 million

Tower Bersama

Tower Bersama

Industry

Infrastructure, Telecom, TMT

All, Singapore,

Transaction size

US$1.2BN

Date

August 2022

Exclusive financial adviser to the consortium led by Macquarie Asset Management on its acquisition of a significant minority stake in Bersama Digital Infrastructure Asia Pte. Ltd. (“BDIA”)

- US$1.2bn investment by Macquarie Asset Management-led consortium into a regional Southeast Asia platform, which owns 73.3% of Tower Bersama as of 3 August 2022

- One of the largest foreign investments into the Indonesian digital infrastructure sector

- US$6.5bn implied Enterprise Value for Tower Bersama

Headquartered in Singapore, BDIA is a Southeast Asian regional digital infrastructure platform that will pursue opportunities in the sector, with a particular focus on telecommunication towers, fibre and data centres.

Tower Bersama

Industry

Infrastructure, Telecom, TMT

Transaction size

US$1.2BN

Date

August 2022

Exclusive financial adviser to the consortium led by Macquarie Asset Management on its acquisition of a significant minority stake in Bersama Digital Infrastructure Asia Pte. Ltd. (“BDIA”)

- US$1.2bn investment by Macquarie Asset Management-led consortium into a regional Southeast Asia platform, which owns 73.3% of Tower Bersama as of 3 August 2022

- One of the largest foreign investments into the Indonesian digital infrastructure sector

- US$6.5bn implied Enterprise Value for Tower Bersama

Headquartered in Singapore, BDIA is a Southeast Asian regional digital infrastructure platform that will pursue opportunities in the sector, with a particular focus on telecommunication towers, fibre and data centres.

Tower BersamaInfrastructure, Telecom, TMT

We were the exclusive financial adviser to the consortium led by Macquarie Asset Management on its acquisition

ISS Philippines

ISS Philippines

Industry

Business Services

All, Philippines,

Transaction size

Undisclosed

Date

September 2021

Adviser to ISS A/S on the divestment of their facilities management business in Philippines to Citadel Pacific Limited

ISS Philippines is a leading provider of outsourced facilities management services in Philippines. It employs over 7,000 staff and commands the largest of share the fragmented facilities management market in Philippines. It has a portfolio of over 120 customers, including large blue-chip multinational companies across the manufacturing, financial, business services and consumer sectors. ISS Philippines was divested in September 2021 to Citadel Pacific Limited, a diversified private holding company with interests across telecommunications, retail, gas distribution, in-flight catering and manpower services.

ISS Philippines

Industry

Business Services

Transaction size

Undisclosed

Date

September 2021

Adviser to ISS A/S on the divestment of their facilities management business in Philippines to Citadel Pacific Limited

ISS Philippines is a leading provider of outsourced facilities management services in Philippines. It employs over 7,000 staff and commands the largest of share the fragmented facilities management market in Philippines. It has a portfolio of over 120 customers, including large blue-chip multinational companies across the manufacturing, financial, business services and consumer sectors. ISS Philippines was divested in September 2021 to Citadel Pacific Limited, a diversified private holding company with interests across telecommunications, retail, gas distribution, in-flight catering and manpower services.

ISS PhilippinesBusiness Services

ISS Philippines is a leading provider of outsourced facilities management services in Philippines. It employs over 7,000 staff...

ISS Environmental Services (HK)

ISS Environmental Services (HK)

Industry

Business Services

All, Hong Kong,

Transaction size

Undisclosed

Date

January 2022

Adviser to ISS A/S on the carve-out and divestment of ISS Environmental Services to ADV Partners

ISS Environmental Services is the market leading provider of portable toilets, sewage management, and mechanical street cleaning in Hong Kong. At the time of the transaction, it managed an extensive network of over 2,500 portable toilets and over 80 specialized vehicles. ISS Environmental Services was acquired by ADV Partners, a leading mid-market Asian private equity firm, in January 2022.

ISS Environmental Services (HK)

Industry

Business Services

Transaction size

Undisclosed

Date

January 2022

Adviser to ISS A/S on the carve-out and divestment of ISS Environmental Services to ADV Partners

ISS Environmental Services is the market leading provider of portable toilets, sewage management, and mechanical street cleaning in Hong Kong. At the time of the transaction, it managed an extensive network of over 2,500 portable toilets and over 80 specialized vehicles. ISS Environmental Services was acquired by ADV Partners, a leading mid-market Asian private equity firm, in January 2022.

ISS Environmental Services (HK)Business Services

ISS Environmental Services is the market leading provider of portable toilets, sewage management, and mechanical street...

TVS Supply Chain Solutions Limited

TVS Supply Chain Solutions Limited

Industry

Transport & Logistics

All, India,

Transaction size

Undisclosed

Date

Sept 2021

Adviser to CDPQ on the sale of its significant minority stake to the promoters, the TVS family.

TVS Supply Chain Solutions Limited (“TVS SCS”) is amongst India’s largest supply chain management companies with a global logistics platform comprising assets in the US, Europe, and Asia. The Group provides a range of supply chain services from integrated supply chain solutions to global forwarding and last mile solutions. TVS SCS is part of the TVS Group, a highly regarded Indian diversified conglomerate established in 1911.

TVS Supply Chain Solutions Limited

Industry

Transport & Logistics

Transaction size

Undisclosed

Date

Sept 2021

Adviser to CDPQ on the sale of its significant minority stake to the promoters, the TVS family.

TVS Supply Chain Solutions Limited (“TVS SCS”) is amongst India’s largest supply chain management companies with a global logistics platform comprising assets in the US, Europe, and Asia. The Group provides a range of supply chain services from integrated supply chain solutions to global forwarding and last mile solutions. TVS SCS is part of the TVS Group, a highly regarded Indian diversified conglomerate established in 1911.

TVS Supply Chain Solutions LimitedTransport & Logistics

Adviser to CDPQ on the sale of its significant minority stake to the promoters, the TVS family. TVS Supply Chain Solutions Limited (“TVS...

Goodpack

Goodpack

Industry

Transport & Logistics

All, Singapore,

Transaction size

US$200m

Date

March 2021

Adviser on the onboarding of China Merchants as a strategic partner to Goodpack (investee company of KKR), with a focus on its development in China

Headquartered in Singapore, Goodpack is a leading supply chain solution provider. Its customers are leaders within the synthetic rubber, finished tire, food processing and automotive component industries. Goodpack owns and operates the largest global fleet of metal returnable containers (c.4m), which are designed to replace incumbent one-way, limited-use or non-cubic form packaging.

Goodpack

Industry

Transport & Logistics

Transaction size

US$200m

Date

March 2021

Adviser on the onboarding of China Merchants as a strategic partner to Goodpack (investee company of KKR), with a focus on its development in China

Headquartered in Singapore, Goodpack is a leading supply chain solution provider. Its customers are leaders within the synthetic rubber, finished tire, food processing and automotive component industries. Goodpack owns and operates the largest global fleet of metal returnable containers (c.4m), which are designed to replace incumbent one-way, limited-use or non-cubic form packaging.

GoodpackTransport & Logistics

Headquartered in Singapore, Goodpack is a leading supply chain solution provider. Its customers are leaders...

Sunningdale

Sunningdale

Industry

Industrials

All, Singapore,

Transaction size

S$320m

Date

February 2021 (Scheme approved, pending completion)

Financial adviser to Sunrise Technology Investment Holding Pte. Ltd. on the acquisition of Sunningdale Tech Ltd. via a scheme of arrangement.

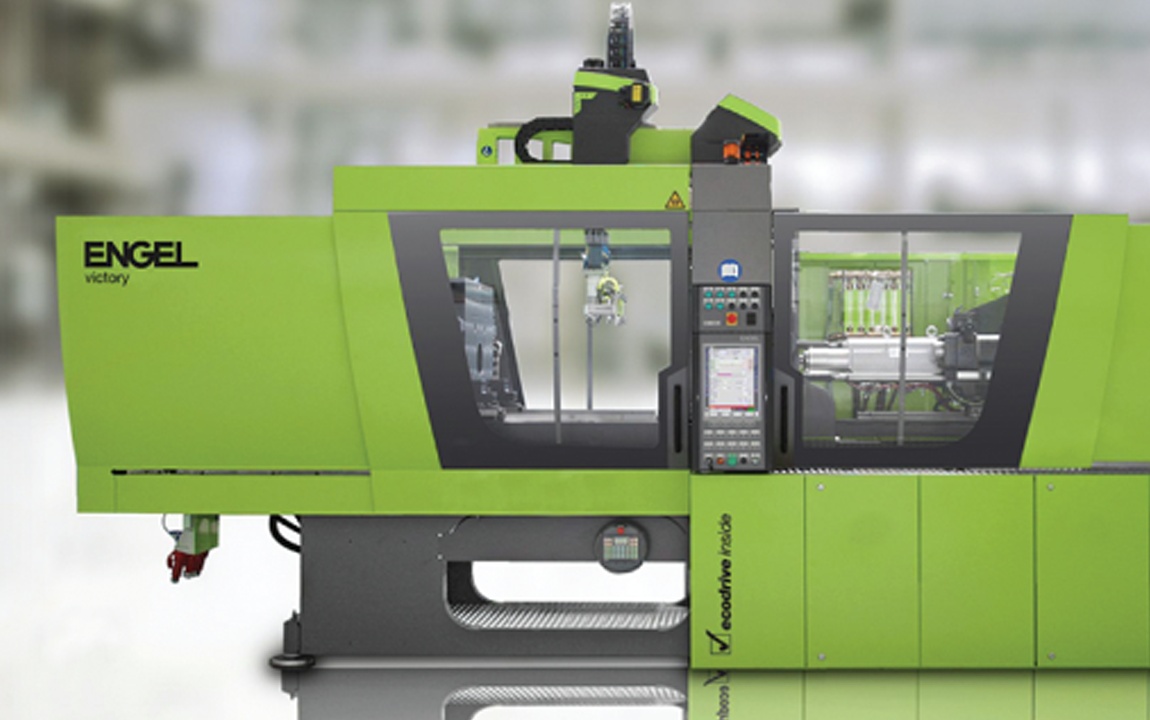

Sunningdale Tech Ltd. is a leading global manufacturer of precision plastic components, headquartered in Singapore. At the time of the transaction, the Sunningdale Group has a total factory space of more than 3 million square feet, with more than 1,000 injection moulding machines and a total capacity of 2,000 moulds per year.

Sunningdale

Industry

Industrials

Transaction size

S$320m

Date

February 2021 (Scheme approved, pending completion)

Financial adviser to Sunrise Technology Investment Holding Pte. Ltd. on the acquisition of Sunningdale Tech Ltd. via a scheme of arrangement.

Sunningdale Tech Ltd. is a leading global manufacturer of precision plastic components, headquartered in Singapore. At the time of the transaction, the Sunningdale Group has a total factory space of more than 3 million square feet, with more than 1,000 injection moulding machines and a total capacity of 2,000 moulds per year.

SunningdaleIndustrials

Sunningdale Tech Ltd. is a leading global manufacturer of precision plastic components...

ISS Malaysia

ISS Malaysia

Industry

Business Services

All, Malaysia,

Transaction size

Undisclosed

Date

October 2020

Adviser to ISS A/S on the divestment of their facilities management business in Malaysia

ISS Malaysia is a provider of complex, high-quality cleaning and hygiene services in Malaysia. It employs over 1,300 staff and is the market leader in the provision of cleanroom cleaning services to semiconductor and precision manufacturing companies in Malaysia. ISS Malaysia was acquired by OCS, a global facilities management company headquartered in the UK.

ISS Malaysia

Industry

Business Services

Transaction size

Undisclosed

Date

October 2020

Adviser to ISS A/S on the divestment of their facilities management business in Malaysia

ISS Malaysia is a provider of complex, high-quality cleaning and hygiene services in Malaysia. It employs over 1,300 staff and is the market leader in the provision of cleanroom cleaning services to semiconductor and precision manufacturing companies in Malaysia. ISS Malaysia was acquired by OCS, a global facilities management company headquartered in the UK.

ISS MalaysiaBusiness Services

ISS Malaysia is a provider of complex, high-quality cleaning and hygiene services in Malaysia. It employs...

ISS Thailand

ISS Thailand

Industry

Business Services

All, Thailand,

Transaction size

US$118m

Date

November 2020

Adviser to ISS A/S on the divestment of their facilities management business in Thailand

ISS Thailand is the market leading provider of cleaning, security, support services and integrated facilities management services with a c.10% market share. It employs over 31,000 staff and serves over 1,000 customers including large, blue-chip multinational companies across manufacturing, retail, automotive, healthcare and aviation sectors. ISS Thailand was acquired by a consortium led by Exacta Capital Partners.

ISS Thailand

Industry

Business Services

Transaction size

US$118m

Date

November 2020

Adviser to ISS A/S on the divestment of their facilities management business in Thailand

ISS Thailand is the market leading provider of cleaning, security, support services and integrated facilities management services with a c.10% market share. It employs over 31,000 staff and serves over 1,000 customers including large, blue-chip multinational companies across manufacturing, retail, automotive, healthcare and aviation sectors. ISS Thailand was acquired by a consortium led by Exacta Capital Partners.

ISS ThailandBusiness Services

ISS Thailand is the market leading provider of cleaning, security, support services and integrated...

European International School

European International School

Industry

Education

All, Vietnam,

Transaction size

Undisclosed

Date

November 2020

Adviser to Verlinvest on a transaction involving one of their education assets in Vietnam, European International School

European International School is an IB-continuum K-12 school located in Ho Chi Minh City in Vietnam. European International School occupies a unique niche as one of the few expat-focused international schools in Ho Chi Minh City, and is one of the fastest growing international schools in the country. In November 2020, EIS officially joined the family of schools owned by Inspired Education, a global K-12 operator backed by GIC, Warburg Pincus, and TA Associates.

European International School

Industry

Education

Transaction size

Undisclosed

Date

November 2020

Adviser to Verlinvest on a transaction involving one of their education assets in Vietnam, European International School

European International School is an IB-continuum K-12 school located in Ho Chi Minh City in Vietnam. European International School occupies a unique niche as one of the few expat-focused international schools in Ho Chi Minh City, and is one of the fastest growing international schools in the country. In November 2020, EIS officially joined the family of schools owned by Inspired Education, a global K-12 operator backed by GIC, Warburg Pincus, and TA Associates.

European International SchoolEducation

European International School is an IB-continuum K-12 school located in Ho Chi Minh City in Vietnam. European International School occupies...

TF Value Mart

TF Value Mart

Industry

Consumer & Retail

All, Malaysia,

Transaction size

Undisclosed

Date

November 2020

Adviser to KV Asia on the sale of TF Value Mart to Intermediate Capital Group (ICG)

TF Value Mart is one of the leading modern grocery retailers in Malaysia. TF Value Mart has a unique strategic focus on the secondary ‘Tier 2/3’ cities in Malaysia, as well as a highly differentiated positioning as a retailer offering a wide selection of fresh produce at highly affordable prices. TF Value Mart was divested to ICG in November 2020, marking one of KV Asia’s most successful investments to date.

TF Value Mart

Industry

Consumer & Retail

Transaction size

Undisclosed

Date

November 2020

Adviser to KV Asia on the sale of TF Value Mart to Intermediate Capital Group (ICG)

TF Value Mart is one of the leading modern grocery retailers in Malaysia. TF Value Mart has a unique strategic focus on the secondary ‘Tier 2/3’ cities in Malaysia, as well as a highly differentiated positioning as a retailer offering a wide selection of fresh produce at highly affordable prices. TF Value Mart was divested to ICG in November 2020, marking one of KV Asia’s most successful investments to date.

TF Value MartConsumer & Retail

TF Value Mart is one of the leading modern grocery retailers in Malaysia. TF Value Mart has a unique strategic...

Philippine Coastal Storage & Pipeline Corporation

Philippine Coastal Storage & Pipeline Corporation

Industry

Oil & Gas Services

All, Philippines,

Transaction size

US$480M

Date

January 2021

Adviser to MIRA on the sale of PCSPC to Keppel Infrastructure Trust and Metro Pacific Investments Corp

Philippine Coastal Storage & Pipeline Corporation (“PCSPC”) is the largest petroleum product storage facility in the Philippines, accounting for nearly 40% of the total import terminal storage capacity in the country. PCSPC is strategically located in Subic Bay with access to the Philippines’ main economic catchment areas, and boasts a blue chip long-standing customer base.

Philippine Coastal Storage & Pipeline Corporation

Industry

Oil & Gas Services

Transaction size

US$480M

Date

January 2021

Adviser to MIRA on the sale of PCSPC to Keppel Infrastructure Trust and Metro Pacific Investments Corp

Philippine Coastal Storage & Pipeline Corporation (“PCSPC”) is the largest petroleum product storage facility in the Philippines, accounting for nearly 40% of the total import terminal storage capacity in the country. PCSPC is strategically located in Subic Bay with access to the Philippines’ main economic catchment areas, and boasts a blue chip long-standing customer base.

Philippine Coastal Storage & Pipeline CorporationOil & Gas Services

Philippine Coastal Storage & Pipeline Corporation (“PCSPC”) is the largest petroleum product storage facility in the Philippines...

Excelity Global Solutions

Excelity Global Solutions

Industry

Technology

All, India,

Transaction size

Undisclosed

Date

May 2020

Adviser to the Everstone Group on the sale of Excelity Global Solutions to Ceridian HCM Holding. The sale process led by Rippledot garnered significant interest from bidders based out of Japan, China, Australia and North America. Ceridian HCM Holding, the winning bidder, is a US-based global human capital management software company.

Excelity Global Solutions is a leading Asia-based human resources outsourcing company operating a proprietary native payroll platform across 13 countries in Asia. The Company delivers over 1.2 million payslips per month and serves more than 300 customers including Forbes, Volvo, Oracle, Emerson, Mammoet, Lufthansa, Mondelez and Uber.

Excelity Global Solutions

Industry

Technology

Transaction size

Undisclosed

Date

May 2020

Adviser to the Everstone Group on the sale of Excelity Global Solutions to Ceridian HCM Holding. The sale process led by Rippledot garnered significant interest from bidders based out of Japan, China, Australia and North America. Ceridian HCM Holding, the winning bidder, is a US-based global human capital management software company.

Excelity Global Solutions is a leading Asia-based human resources outsourcing company operating a proprietary native payroll platform across 13 countries in Asia. The Company delivers over 1.2 million payslips per month and serves more than 300 customers including Forbes, Volvo, Oracle, Emerson, Mammoet, Lufthansa, Mondelez and Uber.

Excelity Global SolutionsTechnology

Adviser to the Everstone Group on the sale of Excelity Global Solutions to Ceridian HCM Holding. The sale process led by Rippledot...

Huang Ji Huang

Huang Ji Huang

Industry

Consumer & Retail

All, China,

Transaction size

Undisclosed

Date

April 2020

Adviser to Morgan Stanley Private Equity and Founder on the sale of the majority interest in Huang Ji Huang to Yum China (NYSE listed). Rippledot ran a broad auction process for the business attracting interest from both strategic as well as financial investors. The deal was signed in August 2019 but completion took a further 8 months driven by both complicated completion conditions as well as onset of COVID-19. Rippledot remained fully dedicated to the transaction throughout the completion period and worked hand-in-hand with management and shareholders to achieve the eventual exit.

Huang Ji Huang is one of the largest Chinese-style casual dining franchise platform in China with more than 600 outlets and 250+ franchisees. Its brand portfolio consists of simmer pot brand “Huang Ji Huang” as well as “San Fen Bao”, a newly launched Chinese fast food concept.

Huang Ji Huang

Industry

Consumer & Retail

Transaction size

Undisclosed

Date

April 2020

Adviser to Morgan Stanley Private Equity and Founder on the sale of the majority interest in Huang Ji Huang to Yum China (NYSE listed). Rippledot ran a broad auction process for the business attracting interest from both strategic as well as financial investors. The deal was signed in August 2019 but completion took a further 8 months driven by both complicated completion conditions as well as onset of COVID-19. Rippledot remained fully dedicated to the transaction throughout the completion period and worked hand-in-hand with management and shareholders to achieve the eventual exit.

Huang Ji Huang is one of the largest Chinese-style casual dining franchise platform in China with more than 600 outlets and 250+ franchisees. Its brand portfolio consists of simmer pot brand “Huang Ji Huang” as well as “San Fen Bao”, a newly launched Chinese fast food concept.

Huang Ji HuangConsumer & Retail

Adviser to Morgan Stanley Private Equity and Founder on the sale of the majority interest in Huang Ji Huang...

Canadian International School

Canadian International School

Industry

Education

All, Singapore,

Transaction size

S$730m

Date

August 2020

Adviser to Southern Capital Group and HPEF Capital Partners on the sale of Canadian International School. Rippledot marketed the asset globally, attracting substantial interest from some of the largest global/regional K-12 operators, buyout funds, infrastructure investors, and sovereign wealth funds and delivered an excellent outcome for our clients despite the recent COVID-19 pandemic.

Canadian International School (“CIS”) is the largest premium for-profit international school in Singapore, educating more than 3,000 students across two campuses. CIS offers the IB curriculum across all K-12 grades and is particularly well known for its highly acclaimed Mandarin-English bilingual program.

Canadian International School

Industry

Education

Transaction size

S$730m

Date

August 2020

Adviser to Southern Capital Group and HPEF Capital Partners on the sale of Canadian International School. Rippledot marketed the asset globally, attracting substantial interest from some of the largest global/regional K-12 operators, buyout funds, infrastructure investors, and sovereign wealth funds and delivered an excellent outcome for our clients despite the recent COVID-19 pandemic.

Canadian International School (“CIS”) is the largest premium for-profit international school in Singapore, educating more than 3,000 students across two campuses. CIS offers the IB curriculum across all K-12 grades and is particularly well known for its highly acclaimed Mandarin-English bilingual program.

Canadian International SchoolEducation

Adviser to Southern Capital Group and HPEF Capital Partners on the sale of Canadian International School...

Thai Credit Retail Bank

Thai Credit Retail Bank

Industry

Financial Services

All, Thailand,

Transaction size

US$85m

Date

May 2019

We were the exclusive financial advisor to Northstar Group on the sale of its 25% stake in Thai Credit Retail Bank to Olympus Capital.

Thai Credit Retail Bank is the fastest growing bank and leading Microfinance provider in Thailand. The bank leverages on its pan-Thailand presence and digital platform to service the growing micro SME, finance and consumer segments. This transaction marks Rippledot’s first foray into Thailand and the FIG sector.

Thai Credit Retail Bank

Industry

Financial Services

Transaction size

US$85m

Date

May 2019

We were the exclusive financial advisor to Northstar Group on the sale of its 25% stake in Thai Credit Retail Bank to Olympus Capital.

Thai Credit Retail Bank is the fastest growing bank and leading Microfinance provider in Thailand. The bank leverages on its pan-Thailand presence and digital platform to service the growing micro SME, finance and consumer segments. This transaction marks Rippledot’s first foray into Thailand and the FIG sector.

Thai Credit Retail BankFinancial Services

We were the exclusive financial advisor to Northstar Group on the sale...

ONE Championship Series E

ONE Championship Series E

Industry

Media & Entertainment

All, Singapore,

Transaction size

US$70m

Date

May 2020

Exclusive advisor to ONE Championship during its latest Series E capital raise from a group of undisclosed investors

ONE Championship is Asia’s largest global sports media property in history with a global broadcast reach of 2.7 billion potential viewers across 150+ countries

ONE Championship Series E

Industry

Media & Entertainment

Transaction size

US$70m

Date

May 2020

Exclusive advisor to ONE Championship during its latest Series E capital raise from a group of undisclosed investors

ONE Championship is Asia’s largest global sports media property in history with a global broadcast reach of 2.7 billion potential viewers across 150+ countries

ONE Championship Series EMedia & Entertainment

Exclusive advisor to ONE Championship during its latest Series E capital...

ONE Championship Series D

ONE Championship Series D

Industry

Media & Entertainment

All, Singapore,

Transaction size

US$166m

Date

October 2018

Exclusive adviser to ONE Championship during its ground-breaking Series D capital raise. Led by Sequoia Global Growth Fund, new investors also included Temasek and Greenoaks Capital.

Singapore-based ONE is the world's largest martial arts organisation and the largest global sports media property in Asia.

ONE Championship Series D

Industry

Media & Entertainment

Transaction size

US$166m

Date

October 2018

Exclusive adviser to ONE Championship during its ground-breaking Series D capital raise. Led by Sequoia Global Growth Fund, new investors also included Temasek and Greenoaks Capital.

Singapore-based ONE is the world's largest martial arts organisation and the largest global sports media property in Asia.

ONE Championship Series DMedia & Entertainment

Exclusive adviser to ONE Championship during its ground-breaking Series D capital raise...

Computer Sciences Corporation

Computer Sciences Corporation

Industry

Technology

Transaction size

US$90m

Date

February 2013

Exclusive financial adviser to Computer Sciences Corporation on the sale of its Southeast Asia Enterprise Solutions & Integration business.

Computer Sciences Corporation is a Fortune 500 company and one of the largest IT services providers in the world. The Enterprise Solutions & Integration business is a value-added reseller of enterprise IT infrastructure products and a provider of systems integration and maintenance services. The business was purchased by a Japanese consortium comprising ITOCHU Techno- Solutions and ITOCHU Corporation.

Computer Sciences Corporation

Industry

Technology

Transaction size

US$90m

Date

February 2013

Exclusive financial adviser to Computer Sciences Corporation on the sale of its Southeast Asia Enterprise Solutions & Integration business.

Computer Sciences Corporation is a Fortune 500 company and one of the largest IT services providers in the world. The Enterprise Solutions & Integration business is a value-added reseller of enterprise IT infrastructure products and a provider of systems integration and maintenance services. The business was purchased by a Japanese consortium comprising ITOCHU Techno- Solutions and ITOCHU Corporation.

Computer Sciences CorporationTechnology

Computer Sciences Corporation is a Fortune 500 company and one of the largest IT services providers in the world...

Orange Valley

Orange Valley

Industry

Healthcare

All, Singapore,

Transaction size

S$165m

Date

April 2017

Exclusive adviser to KV Asia Capital on the sale of Orange Valley Healthcare to Singapore Press Holdings, following a competitive global tender process.

Orange Valley is the largest private nursing home operator in Singapore with six facilities and a combined bed capacity of over 1,000 residents - almost 25% of all private bed capacity in the market. The group boasts industry-leading clinical capabilities and standards underpinned by one of the most experienced and highly-trained nursing workforces in Singapore.

Orange Valley

Industry

Healthcare

Transaction size

S$165m

Date

April 2017

Exclusive adviser to KV Asia Capital on the sale of Orange Valley Healthcare to Singapore Press Holdings, following a competitive global tender process.

Orange Valley is the largest private nursing home operator in Singapore with six facilities and a combined bed capacity of over 1,000 residents - almost 25% of all private bed capacity in the market. The group boasts industry-leading clinical capabilities and standards underpinned by one of the most experienced and highly-trained nursing workforces in Singapore.

Orange ValleyHealthcare

Orange Valley is the largest private nursing home operator in Singapore with six facilities and a combined bed capacity of over...

Whispir

Whispir

Industry

Technology

All, Australia,

Transaction size

Undisclosed

Date

November 2017

Exclusive adviser to Whispir during its successful Series B capital raise led by MDI Ventures.

Founded in 2002 and headquartered in Australia, Whispir is a cloud-based communications platform that uses cutting edge technology to bring all communications channels together in one easily accessible space.

Whispir

Industry

Technology

Transaction size

Undisclosed

Date

November 2017

Exclusive adviser to Whispir during its successful Series B capital raise led by MDI Ventures.

Founded in 2002 and headquartered in Australia, Whispir is a cloud-based communications platform that uses cutting edge technology to bring all communications channels together in one easily accessible space.

WhispirTechnology

Founded in 2002 and headquartered in Australia, Whispir is a cloud-based communications platform that uses...

Nera Payment Solutions

Nera Payment Solutions

Industry

Technology

All, Singapore,

Transaction size

S$88m

Date

May 2016

Management of a global auction process and the concurrent carve-out of Nera Telecommunications payment-solutions businesses across Asia (creating new legal entities) prior to the subsequent sale of Nera Payment Solutions to the Ingenico Group.

Headquartered in Singapore, Nera Payment Solutions is the largest systems integrator of payment terminals in Southeast Asia serving Tier 1 banks and retail industries. Rippledot Capital advised Nera Telecommunications Ltd a Northstar Group investee company on the sale, the result of which was a gain on book value of approximately S$72 million.

Nera Payment Solutions

Industry

Technology

Transaction size

S$88m

Date

May 2016

Management of a global auction process and the concurrent carve-out of Nera Telecommunications payment-solutions businesses across Asia (creating new legal entities) prior to the subsequent sale of Nera Payment Solutions to the Ingenico Group.

Headquartered in Singapore, Nera Payment Solutions is the largest systems integrator of payment terminals in Southeast Asia serving Tier 1 banks and retail industries. Rippledot Capital advised Nera Telecommunications Ltd a Northstar Group investee company on the sale, the result of which was a gain on book value of approximately S$72 million.

Nera Payment SolutionsTechnology

Headquartered in Singapore, Nera Payment Solutions is the largest systems integrator of payment terminals in...

Nera Telecommunications

Nera Telecommunications

Industry

Technology

All, Singapore,

Transaction size

S$89m

Date

November 2012

Adviser to Oslo Børs-listed Eltek ASA on the sale of its 50.1% percent stake in SGX-listed company Nera Telecommunications to the Northstar Group.

Nera Telecommunications is one of Southeast Asia’s largest independent systems integrators for telecom and infocom networks. Headquartered in Singapore, it has operations in 14 countries in Southeast Asia, India, Middle East and North Africa with long-standing strategic relationships with Tier 1 telecom service providers in these regions.

Nera Telecommunications

Industry

Technology

Transaction size

S$89m

Date

November 2012

Adviser to Oslo Børs-listed Eltek ASA on the sale of its 50.1% percent stake in SGX-listed company Nera Telecommunications to the Northstar Group.

Nera Telecommunications is one of Southeast Asia’s largest independent systems integrators for telecom and infocom networks. Headquartered in Singapore, it has operations in 14 countries in Southeast Asia, India, Middle East and North Africa with long-standing strategic relationships with Tier 1 telecom service providers in these regions.

Nera TelecommunicationsTechnology

Nera Telecommunications is one of Southeast Asia’s largest independent systems integrators for telecom and infocom...

Miclyn Express Offshore

Miclyn Express Offshore

Industry

Oil & Gas Services

All, Singapore,

Transaction size

A$869m - Series of 4 transactions totalling

Date

August 2011 - November 2013

Adviser to a consortium consisting of CHAMP Private Equity and Headland Capital Partners on the acquisition and re-financing of ASX-listed Miclyn Express Offshore.

Miclyn Express Offshore is a leading provider of offshore support vessels, crew boats, tugs, barges and associated support services to the oil and gas industry. Headquartered in Singapore the company has operations in Southeast Asia, Australia and the Middle East.

Miclyn Express Offshore

Industry

Oil & Gas Services

Transaction size

A$869m - Series of 4 transactions totalling

Date

August 2011 - November 2013

Adviser to a consortium consisting of CHAMP Private Equity and Headland Capital Partners on the acquisition and re-financing of ASX-listed Miclyn Express Offshore.

Miclyn Express Offshore is a leading provider of offshore support vessels, crew boats, tugs, barges and associated support services to the oil and gas industry. Headquartered in Singapore the company has operations in Southeast Asia, Australia and the Middle East.

Miclyn Express OffshoreOil & Gas Services

Miclyn Express Offshore is a leading provider of offshore support vessels, crew boats, tugs, barges and associated...

Kreuz Holdings

Kreuz Holdings

Industry

Oil & Gas Services

All, Singapore,

Transaction size

S$462m

Date

February 2014

Exclusive financial adviser to Funds advised by Headland Capital Partners, on the acquisition of Kreuz Holdings via a scheme of arrangement.

Headquartered in Singapore, Kreuz is an integrated subsea services business, providing construction and installation solutions and inspection, repair and maintenance services for offshore oil and gas projects and facilities in ASEAN and India.

Kreuz Holdings

Industry

Oil & Gas Services

Transaction size

S$462m

Date

February 2014

Exclusive financial adviser to Funds advised by Headland Capital Partners, on the acquisition of Kreuz Holdings via a scheme of arrangement.

Headquartered in Singapore, Kreuz is an integrated subsea services business, providing construction and installation solutions and inspection, repair and maintenance services for offshore oil and gas projects and facilities in ASEAN and India.

Kreuz HoldingsOil & Gas Services

Headquartered in Singapore, Kreuz is an integrated subsea services business, providing construction and installation...

Tat Hong

Tat Hong

Industry

Industrials

All, Singapore,

Transaction size

S$756 million

Date

June 2018

Financial and strategic adviser to Tat Hong on its privatisation from the Singapore Stock Exchange.

Founded in the 1970s, Tat Hong is a Singapore-headquartered supplier of cranes and heavy equipment. The company is one of the largest crane rental and distribution companies in the world.

Tat Hong

Industry

Industrials

Transaction size

S$756 million

Date

June 2018

Financial and strategic adviser to Tat Hong on its privatisation from the Singapore Stock Exchange.

Founded in the 1970s, Tat Hong is a Singapore-headquartered supplier of cranes and heavy equipment. The company is one of the largest crane rental and distribution companies in the world.

Tat HongIndustrials

Founded in the 1970s, Tat Hong is a Singapore-headquartered supplier of cranes and heavy equipment...

Goodpack

Goodpack

Industry

Transport & Logistics

All, Singapore,

Transaction size

S$1.6bn

Date

September 2014

Exclusive financial adviser to Goodpack on its acquisition, via a scheme of arrangement, by a wholly-owned subsidiary of KKR Asian Fund II.

Goodpack is the world’s largest provider of multi-modal reusable metal box systems and delivers reliable and cost-effective packing solutions to clients in over 70 countries worldwide.

Goodpack

Industry

Transport & Logistics

Transaction size

S$1.6bn

Date

September 2014

Exclusive financial adviser to Goodpack on its acquisition, via a scheme of arrangement, by a wholly-owned subsidiary of KKR Asian Fund II.

Goodpack is the world’s largest provider of multi-modal reusable metal box systems and delivers reliable and cost-effective packing solutions to clients in over 70 countries worldwide.

GoodpackTransport & Logistics

Goodpack is the world’s largest provider of multi-modal reusable metal box systems and delivers reliable...

Zimplistic

Zimplistic

Industry

Technology

All, Singapore,

Transaction size

US$30m

Date

April 2018

Adviser to Zimplistic throughout its successful Series C capital raise, led by Credence and EDBI.

Headquartered in Singapore, Zimplistic is a product design company specialising in intelligent kitchen appliances designed to promote healthy eating through automation. Zimplistic is the company behind the Rotimatic, a fully-automated flatbread making machine launched in 2016 and powered by robotics, machine learning and IoT.

Zimplistic

Industry

Technology

Transaction size

US$30m

Date

April 2018

Adviser to Zimplistic throughout its successful Series C capital raise, led by Credence and EDBI.

Headquartered in Singapore, Zimplistic is a product design company specialising in intelligent kitchen appliances designed to promote healthy eating through automation. Zimplistic is the company behind the Rotimatic, a fully-automated flatbread making machine launched in 2016 and powered by robotics, machine learning and IoT.

ZimplisticTechnology

Headquartered in Singapore, Zimplistic is a product design company specialising in intelligent kitchen appliances...

Unisteel

Unisteel

Industry

Industrials

Transaction size

Undisclosed

Date

August 2012

Exclusive adviser to KKR on the sale of Unisteel Technology to SFS Group.

Unisteel Technology is a leading precision engineering company serving a diverse range of customers in the hard disk drive, mobile telecommunications, consumer electronics, industrial, and automotive sectors. The transaction marks the first full exit by KKR from an asset in its first pan- Asia fund.

Unisteel

Industry

Industrials

Transaction size

Undisclosed

Date

August 2012

Exclusive adviser to KKR on the sale of Unisteel Technology to SFS Group.

Unisteel Technology is a leading precision engineering company serving a diverse range of customers in the hard disk drive, mobile telecommunications, consumer electronics, industrial, and automotive sectors. The transaction marks the first full exit by KKR from an asset in its first pan- Asia fund.

UnisteelIndustrials

Unisteel Technology is a leading precision engineering company serving a diverse range of customers in the hard disk drive...

First Engineering

First Engineering

Industry

Industrials

All, Singapore,

Transaction size

US$80m

Date

November 2014

Exclusive financial adviser to Anchorage Capital Partners on the sale of First Engineering to SGX-listed Sunningdale Tech.

The sale of Singapore-based First Engineering to Sunningdale Tech, also based in Singapore, created a combined precision plastics manufacturing company with annual revenues in excess of US$500 million and manufacturing and sales operations spanning nine countries. Having advised Anchorage on their acquisition of First Engineering in 2012, Rippledot delivered highly attractive returns for its client in little more than a 2 year timeframe.

First Engineering

Industry

Industrials

Transaction size

US$80m

Date

November 2014

Exclusive financial adviser to Anchorage Capital Partners on the sale of First Engineering to SGX-listed Sunningdale Tech.

The sale of Singapore-based First Engineering to Sunningdale Tech, also based in Singapore, created a combined precision plastics manufacturing company with annual revenues in excess of US$500 million and manufacturing and sales operations spanning nine countries. Having advised Anchorage on their acquisition of First Engineering in 2012, Rippledot delivered highly attractive returns for its client in little more than a 2 year timeframe.

First EngineeringIndustrials

The sale of Singapore-based First Engineering to Sunningdale Tech, also based in Singapore, created a combined precision...

First Engineering

First Engineering

Industry

Industrials

All, Singapore,

Transaction size

US$33m

Date

June 2012

Exclusive adviser to Australia-based private equity firm Anchorage Capital Partners on their acquisition of First Engineering.

First Engineering is a leading precision plastics component manufacturer based in Singapore. The transaction marked an exit for First Engineering’s senior lenders, following the S$221 million leveraged buyout of First Engineering by Affinity Equity Partners in 2007, and the subsequent restructuring and debt-for-equity swap in 2009.

First Engineering

Industry

Industrials

Transaction size

US$33m

Date

June 2012

Exclusive adviser to Australia-based private equity firm Anchorage Capital Partners on their acquisition of First Engineering.

First Engineering is a leading precision plastics component manufacturer based in Singapore. The transaction marked an exit for First Engineering’s senior lenders, following the S$221 million leveraged buyout of First Engineering by Affinity Equity Partners in 2007, and the subsequent restructuring and debt-for-equity swap in 2009.

First EngineeringIndustrials

First Engineering is a leading precision plastics component manufacturer based in Singapore. The transaction...

Seksun

Seksun

Industry

Industrials

Transaction size

US$145m

Date

November 2014

Exclusive financial adviser to the Rohatyn Group on the sale of the Seksun Group to Suzhou Anjie Technology; a Shenzhen-listed manufacturer within the consumer electronics industry.

Seksun Group is a leading precision metals engineering solutions provider serving the hard disk drive, automotive, industrial, and consumer electronics industries.

Seksun

Industry

Industrials

Transaction size

US$145m

Date

November 2014

Exclusive financial adviser to the Rohatyn Group on the sale of the Seksun Group to Suzhou Anjie Technology; a Shenzhen-listed manufacturer within the consumer electronics industry.

Seksun Group is a leading precision metals engineering solutions provider serving the hard disk drive, automotive, industrial, and consumer electronics industries.

SeksunIndustrials

Seksun Group is a leading precision metals engineering solutions provider serving the hard disk drive...

Innovalues

Innovalues

Industry

Industrials

All, Singapore,

Transaction size

S$334m

Date

March 2017

Adviser to Innovalues throughout a competitive auction process, its sale to Northstar Group and subsequent privatisation from the Singapore Stock Exchange.

Headquartered in Singapore, Innovalues is a leading supplier of high-precision, customised machined components to market leaders in the automotive sensor, engine and transmission industries. It employs over 1,600 staff in eight strategically-located, vertically-integrated and cost-competitive manufacturing facilities in Malaysia, Thailand and China.

Innovalues

Industry

Industrials

Transaction size

S$334m

Date

March 2017

Adviser to Innovalues throughout a competitive auction process, its sale to Northstar Group and subsequent privatisation from the Singapore Stock Exchange.

Headquartered in Singapore, Innovalues is a leading supplier of high-precision, customised machined components to market leaders in the automotive sensor, engine and transmission industries. It employs over 1,600 staff in eight strategically-located, vertically-integrated and cost-competitive manufacturing facilities in Malaysia, Thailand and China.

InnovaluesIndustrials

Headquartered in Singapore, Innovalues is a leading supplier of high-precision, customised machined...

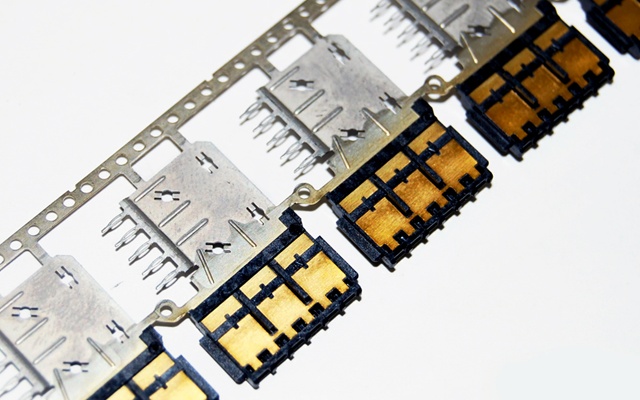

Interplex

Interplex

Industry

Industrials

All, Singapore,

Transaction size

US$567m

Date

March 2016

Joint financial adviser to CVC Capital Partners and Standard Chartered Private Equity on the sale of their 56% interest in Interplex to a special purpose vehicle sponsored by Baring Private Equity Asia.

Headquartered in Singapore, but with 12,000 employees and 40 facilities worldwide, Interplex is a leading provider of complex precision mechanical and electro-mechanical components and assemblies to a diverse range of industries.

Interplex

Industry

Industrials

Transaction size

US$567m

Date

March 2016

Joint financial adviser to CVC Capital Partners and Standard Chartered Private Equity on the sale of their 56% interest in Interplex to a special purpose vehicle sponsored by Baring Private Equity Asia.

Headquartered in Singapore, but with 12,000 employees and 40 facilities worldwide, Interplex is a leading provider of complex precision mechanical and electro-mechanical components and assemblies to a diverse range of industries.

InterplexIndustrials

Headquartered in Singapore, but with 12,000 employees and 40 facilities worldwide, Interplex is...

Amtek Engineering

Amtek Engineering

Industry

Industrials

Transaction size

US$210m

Date

August 2014

Strategic and Financial adviser to SGX-listed Amtek Engineering on the acquisition of American-based Interplex Industries.

Interplex is a global leader in the design and manufacture of miniature precision engineered solutions. Together Amtek, owned by CVC and Standard Chartered Private Equity, and Interplex form one of the world’s largest precision engineering companies with global annual sales of approximately US$1 billion.

Amtek Engineering

Industry

Industrials

Transaction size

US$210m

Date

August 2014

Strategic and Financial adviser to SGX-listed Amtek Engineering on the acquisition of American-based Interplex Industries.

Interplex is a global leader in the design and manufacture of miniature precision engineered solutions. Together Amtek, owned by CVC and Standard Chartered Private Equity, and Interplex form one of the world’s largest precision engineering companies with global annual sales of approximately US$1 billion.

Amtek EngineeringIndustrials

Interplex is a global leader in the design and manufacture of miniature precision engineered solutions. Together Amtek...

ILA Vietnam

ILA Vietnam

Industry

Education

All, Vietnam,

Transaction size

Undisclosed

Date

July 2017

Strategic adviser to the consortium led by Headland Capital Partners on the sale of their Vietnamese private education business to the EQT Mid-Market Fund.

ILA Vietnam is the leading provider of premium English language training (“ELT”) services in Vietnam, with over 20,000 ELT enrolments nationwide across more than 30 centres. Since its establishment in the mid-1990s, ILA has been a pioneer in the ELT industry and was the first to introduce 100% native English speaking foreign teachers.

ILA Vietnam

Industry

Education

Transaction size

Undisclosed

Date

July 2017

Strategic adviser to the consortium led by Headland Capital Partners on the sale of their Vietnamese private education business to the EQT Mid-Market Fund.

ILA Vietnam is the leading provider of premium English language training (“ELT”) services in Vietnam, with over 20,000 ELT enrolments nationwide across more than 30 centres. Since its establishment in the mid-1990s, ILA has been a pioneer in the ELT industry and was the first to introduce 100% native English speaking foreign teachers.

ILA VietnamEducation

ILA Vietnam is the leading provider of premium English language training (“ELT”) services in Vietnam...

One Championship Series C

One Championship Series C

Industry

Media & Entertainment

All, Singapore,

Transaction size

Undisclosed

Date

July 2017

Adviser to ONE Championship throughout its hugely successful Series C capital raise from investors, including Sequoia Capital.

Launched in 2011 ONE Championship runs Mixed Martial Arts events across Asia-Pacific and broadcasts on T.V. and social media to over 1.7 billion viewers in 138 countries worldwide.

One Championship Series C

Industry

Media & Entertainment

Transaction size

Undisclosed

Date

July 2017

Adviser to ONE Championship throughout its hugely successful Series C capital raise from investors, including Sequoia Capital.

Launched in 2011 ONE Championship runs Mixed Martial Arts events across Asia-Pacific and broadcasts on T.V. and social media to over 1.7 billion viewers in 138 countries worldwide.

One Championship Series CMedia & Entertainment

Launched in 2011 ONE Championship runs Mixed Martial Arts events across Asia-Pacific...

Classic Fine Foods

Classic Fine Foods

Industry

Consumer & Retail

All, Singapore,

Transaction size

US$328m

Date

August 2015

Exclusive financial adviser to the EQT Greater China II Fund on the sale of Classic Fine Foods to Metro Group, a German company and one of the largest international investors in the food and hospitality sector.

Classic Fine Foods is a leading premium food service business headquartered in Singapore. It represents the brands of some of the world’s top food producers and serves chefs in premium restaurants and hotels across its 12 markets and 25 cities in Asia, the Middle East and the U.K.

Classic Fine Foods

Industry

Consumer & Retail

Transaction size

US$328m

Date

August 2015

Exclusive financial adviser to the EQT Greater China II Fund on the sale of Classic Fine Foods to Metro Group, a German company and one of the largest international investors in the food and hospitality sector.

Classic Fine Foods is a leading premium food service business headquartered in Singapore. It represents the brands of some of the world’s top food producers and serves chefs in premium restaurants and hotels across its 12 markets and 25 cities in Asia, the Middle East and the U.K.

Classic Fine FoodsConsumer & Retail

Classic Fine Foods is a leading premium food service business headquartered in Singapore. It represents...

Myanmar Brewery

Myanmar Brewery

Industry

Consumer & Retail

All, Myanmar,

Transaction size

US$560m

Date

August 2015

Adviser to Kirin on their acquisition of a 55% shareholding in Myanmar Brewery from Fraser and Neave.

Headquartered in Tokyo, Kirin is one of the world’s largest beverage companies. Myanmar Brewery is the owner of a portfolio of several well-known brands, including Myanmar Beer, and has a dominant market share in the national beer market. The acquisition by Kirin is the largest M&A deal ever realised in Myanmar, representing an implied 100% equity valuation of c.US$1 billion.

Myanmar Brewery

Industry

Consumer & Retail

Transaction size

US$560m

Date

August 2015

Adviser to Kirin on their acquisition of a 55% shareholding in Myanmar Brewery from Fraser and Neave.

Headquartered in Tokyo, Kirin is one of the world’s largest beverage companies. Myanmar Brewery is the owner of a portfolio of several well-known brands, including Myanmar Beer, and has a dominant market share in the national beer market. The acquisition by Kirin is the largest M&A deal ever realised in Myanmar, representing an implied 100% equity valuation of c.US$1 billion.

Myanmar BreweryConsumer & Retail

Headquartered in Tokyo, Kirin is one of the world’s largest beverage companies. Myanmar Brewery...

Jiahao Foodstuff

Jiahao Foodstuff

Industry

Consumer & Retail

All, China,

Transaction size

US$694m

Date

September 2018

Exclusive strategic and financial adviser to Unitas Capital on the sale of Jiahao Foodstuff to Huabao International.

Headquartered in Zhongshan China, Jiahao Foodtuff is a market leader in the supply of a broad range of high-quality condiment products (chicken bouillon, wasabi paste, cooking juice, etc.) to foodservice customers in China. Rippledot’s highly involved management of the deal led to an exceptional financial outcome and solidified Rippledot’s position as adviser of choice for Asia-based private equity clients seeking to run a highly targeted global sale process.

Jiahao Foodstuff

Industry

Consumer & Retail

Transaction size

US$694m

Date

September 2018

Exclusive strategic and financial adviser to Unitas Capital on the sale of Jiahao Foodstuff to Huabao International.

Headquartered in Zhongshan China, Jiahao Foodtuff is a market leader in the supply of a broad range of high-quality condiment products (chicken bouillon, wasabi paste, cooking juice, etc.) to foodservice customers in China. Rippledot’s highly involved management of the deal led to an exceptional financial outcome and solidified Rippledot’s position as adviser of choice for Asia-based private equity clients seeking to run a highly targeted global sale process.

Jiahao FoodstuffConsumer & Retail

Headquartered in Zhongshan China, Jiahao Foodtuff is a market leader in the supply...

Antares Restaurant Group

Antares Restaurant Group

Industry

Consumer & Retail

All, Australia,

Transaction size

NZ$156m

Date

November 2011

Adviser to Australia-based private equity firm Anchorage Capital Partners on the sale of the Antares Restaurant Group to the Blackstone Group.

Antares is headquartered in Auckland and has the exclusive franchise development rights for Burger King in New Zealand. The sale was preceded by a competitive global tender process.

Antares Restaurant Group

Industry

Consumer & Retail

Transaction size

NZ$156m

Date

November 2011

Adviser to Australia-based private equity firm Anchorage Capital Partners on the sale of the Antares Restaurant Group to the Blackstone Group.

Antares is headquartered in Auckland and has the exclusive franchise development rights for Burger King in New Zealand. The sale was preceded by a competitive global tender process.

Antares Restaurant GroupConsumer & Retail

Antares is headquartered in Auckland and has the exclusive franchise development...

Asia Pacific Schools

Asia Pacific Schools

Industry

Education

All, Malaysia,

Transaction size

Undisclosed

Date

May 2019

Adviser to KV Asia on the sale of Asia Pacific Schools, a K-12 private school group in Malaysia, to the International Schools Partnership; Rippledot ran a global auction process, achieving transaction-signing within 4 months of the launch of the sale process.

Owned since 2018 by KV Asia, the APIIT Group is a tertiary education business in Malaysia. The sale of Asia Pacific Schools separated out the smaller K-12 arm of the Group, comprised of two international schools responsible for educating over 2000 pupils aged between 3 and 18 in Kuala Lumpur. Following the deal, APS became the 40th school to join the ISP portfolio; ISP is an international K-12 operator (backed by the Partners Group) with schools across Malaysia, Mexico, Costa Rica, USA, UK, Chile, UAE, and Qatar.

Asia Pacific Schools

Industry

Education

Transaction size

Undisclosed

Date

May 2019

Adviser to KV Asia on the sale of Asia Pacific Schools, a K-12 private school group in Malaysia, to the International Schools Partnership; Rippledot ran a global auction process, achieving transaction-signing within 4 months of the launch of the sale process.

Owned since 2018 by KV Asia, the APIIT Group is a tertiary education business in Malaysia. The sale of Asia Pacific Schools separated out the smaller K-12 arm of the Group, comprised of two international schools responsible for educating over 2000 pupils aged between 3 and 18 in Kuala Lumpur. Following the deal, APS became the 40th school to join the ISP portfolio; ISP is an international K-12 operator (backed by the Partners Group) with schools across Malaysia, Mexico, Costa Rica, USA, UK, Chile, UAE, and Qatar.

Asia Pacific SchoolsEducation

Owned since 2018 by KV Asia, the APIIT Group is a tertiary education business in Malaysia. The sale...